Gold has run up a lot recently with people exclaiming about the wisdom of their grandmothers and Indian Women in general who own 11 % of the Gold that was ever mined, about 24000 tons. To give you a context this is more Gold than that held as reserve by the top 5 Gold owning countries (Government treasury) put together.

I’m sure our grandmother’s had a lot of wisdom, but with times we have changed our life to suit our needs and objectives. In the same way, let us review the most common perceptions of Gold and see if the data supports it.

Is gold truly a safer asset with better returns? Let’s examine the data.

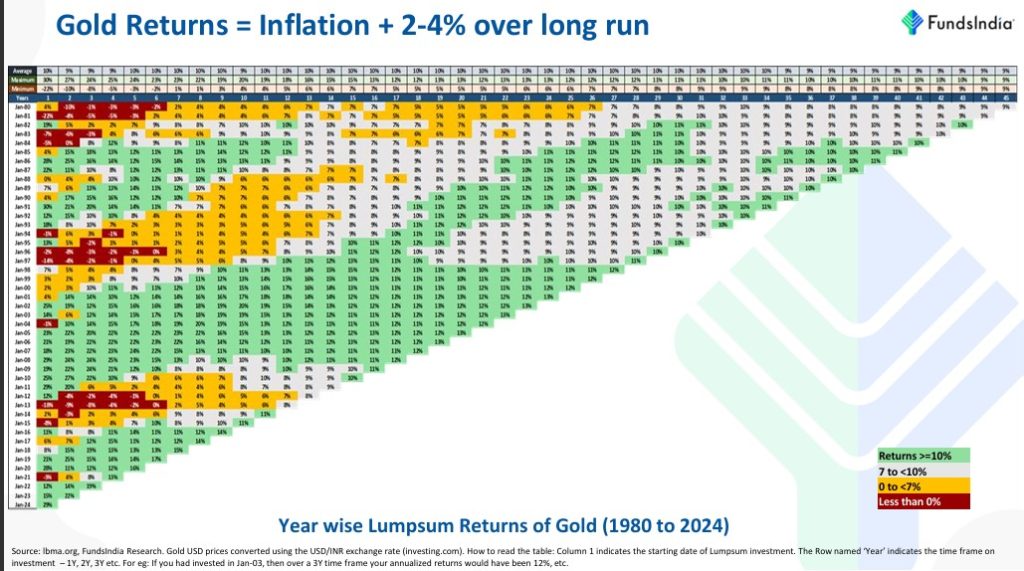

Does Gold beat Inflation?

Heat Map of Returns of Gold over 44 years

On examining the data between 1980 – 2024, we see that gold has outperformed inflation by 2 – 4% on an average. So answer is ‘Definitely‘

A lot of investors think why go through so much trouble for a 2 – 3 % extra, I would rather stick to proven asset of Gold and have peace of mind. Risk in Equity comes from its volatility. So let us examine if gold is less Volatile than Equity.

So is Gold Better than Equity ?

Let us split this into three questions :

Does Gold give better returns than Equity?

Gold Vs Equities

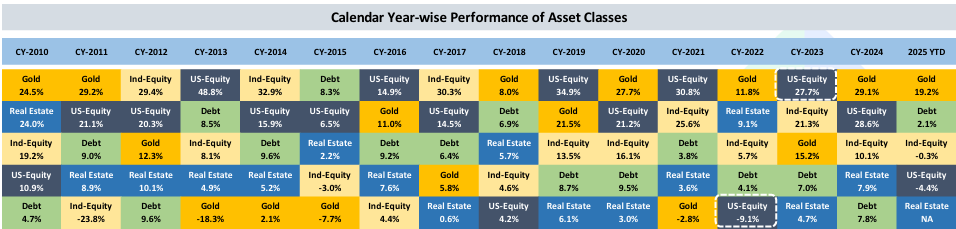

If we look at year wise returns between 2000 – 2024 , we can see that Gold has underperformed equities i.e NIFTY TRI index by 2 – 3 % over a long period of 15 – 20 yrs. So we can conclusively say Equity is a better performing asset than Gold.

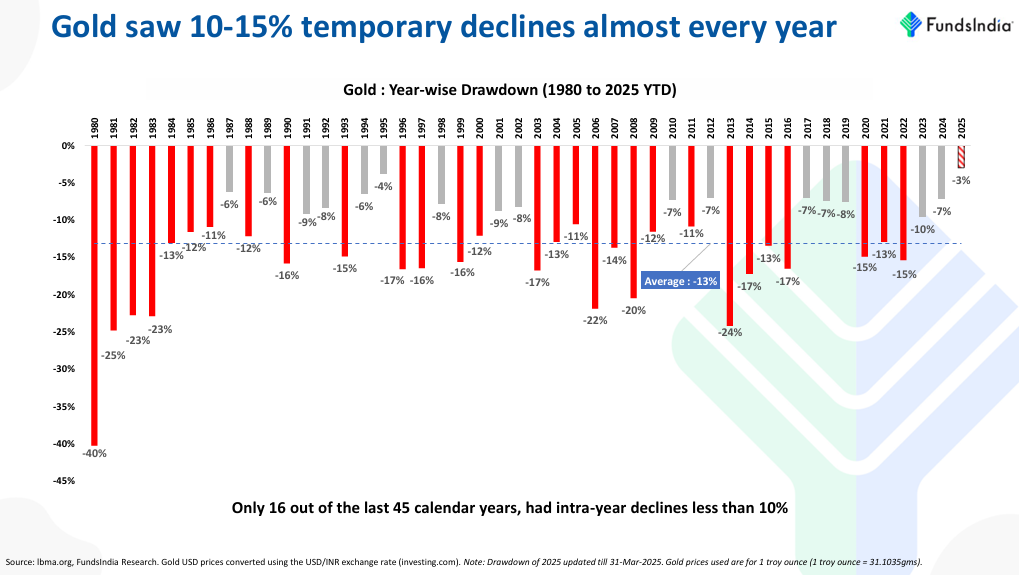

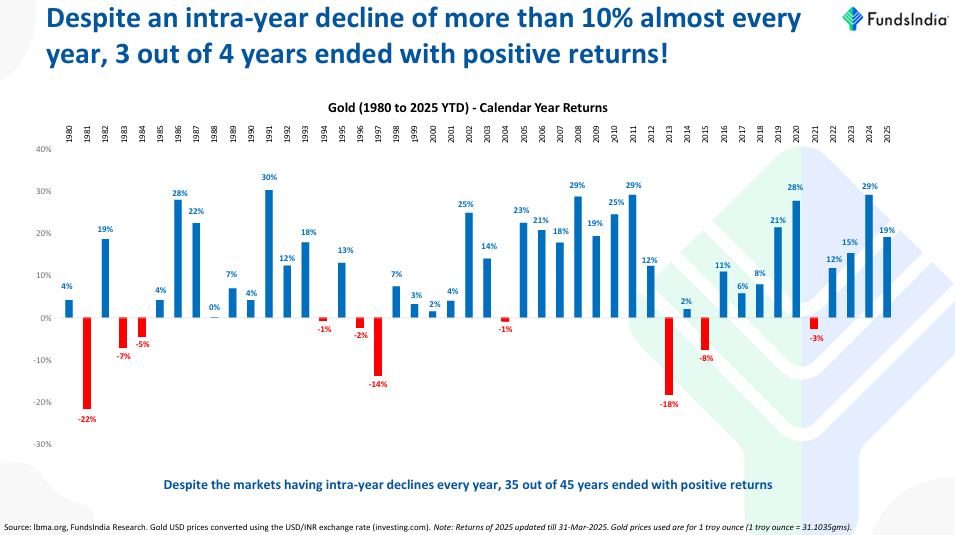

Has Gold’s increase in prices been steady like say a Fixed Deposit. Can it really give peace of mind ?

Looking at data since 1980, we see Gold’s worst decline was in the year 1980 where it had intra year decline of 40 %. Gold has had multiple intra year declines of 20 % + with average intra year decline for this time being at 13%

But despite the intra year decline, Gold did end up positive 77.78% of the time, with inflation beating returns on an average. And yes, our Grandmother where indeed happy to buy more when Gold declined during this period and also consistently on occasions such as Dantheras. This indeed is the old Granny wisdom that we should follow of buying timeless assets when they are available cheaper.

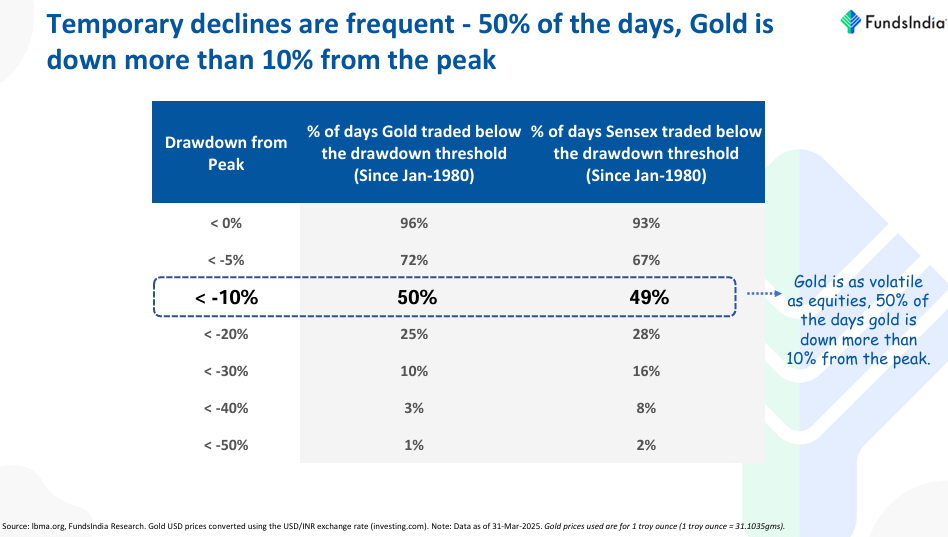

The volatility looks shocking but it’s probably better than Equity. Is’nt it ?

Not really. 10 % decline from peak has happened in Gold about 50 % of the time and Equity (i.e Sensex) about 49 % and 20 % decline has happened about 25 % , 28 % in Gold and Equity respectively.

What drives Gold prices?

- Gold is popularly considered inflation hedge, and is inversely correlated to US Real yields (i.e) interest rates.

- USD – INR Exchange rate (which are also driven by interest rates in the two countries)

- Demand – Supply which are driven by geo political reasons due to popular perception of being a safe asset.

So what is Gold’s Role in a Portfolio ?

Gold can serve as a hedge against inflation, currency fluctuations, and geopolitical uncertainty. However, it’s crucial to maintain a balanced allocation, as gold’s performance can be volatile. Often Gold outperforms in conditions that causes underperformance of Equity. Hence an allocation to Gold can smoothen out the performance of a portfolio over long periods of time.

So should I buy Gold or not ? Or should I buy Silver ?

Different asset classes perform well over different periods of time. Investors must understand that returns come future performance and not past performance. Like the genius scientist, Niels Bohr said, “It’s difficult to predict. Especially if its about the future.”

While no one has consistently predicted the top and bottom of any cycle, I can say with conviction that chasing returns is one of the sure shot way to underperform.

So what should I do ?

Asset Allocation

A well-diversified portfolio typically includes a mix of asset classes, including equities, bonds, and alternatives like gold. The ideal allocation depends on individual financial goals, risk tolerance, and time horizon. Your Advisor will be able to help you determine the same. If you don’t have one, please feel free to reach out to invest under my guidance.

And Grandmother’s Wisdom?

Grandmother was still wise because:

(1) She chose to save money in Gold over spending it on day to day needs

(2) Gold is better than cash in rice/atta dabba as cash loses value with inflation and Gold doesn’t.

(3) Gold is universally accepted.

(4) Grandmother did not panic when Gold prices dropped. She bought more.

(5)She also bought in frequent intervals like Akshaya Tritiyi, Dhanteras etc and was not hoping to time the market.

(6) She did not have access to bank accounts and mutuals funds but followed sound investing principles.

Conclusion

While gold can be a valuable addition to a diversified portfolio, it’s essential to maintain a balanced allocation and avoid making emotional decisions based on short-term market fluctuations. By sticking to a well-planned asset allocation strategy, investors can work towards achieving their long-term financial goals and follow the sound investing principles of your grandmother.