CEO’s of Indian AMC’s which manage over 50,000 Crores of Investor Money came together in this event conducted by Network FP to share the strange yet simple secrets of Wealth Creation for the benefit of over 10,000 investors.

Secret 11 – Godfather of Wealth : Trust India’s growth Story

India’s growth story and transformation was shared by Mr. Navneet Munhot of HDFC MF. This especially in contrast with the turbulent times in Europe (Russia – Ukraine War), China’s Banking Crisis etc. The burgeoning SIP book has also reduced structural risk of FII’s and has provided the market a lot of stability.

The Story of Two Cities : Shangai Index and Mumbai (Sensex)

While China’s GDP and corporate profits has grown rapidly in the last 10 years from 2003 to 2023, Shanghai Index has merely doubled from 1500 to 3000. However during the same period Indian markets have become 25x. World is beginning to see India as a premium market and the next 25 years is expected to look even better.

What makes India Stand Out:

-> 5 D’s – Digitalization, Democracy, Demonetization, Determination, Demographics

-> RRR – Rail , Road, Renewables

-> 30 Trillion $ economy – Projected

Wealth Creation = Sound Investment + Time + Patience

Secret 10- Multiplier of Wealth : Participation in Equity Markets

This secret of Wealth Creation was presented by Mr. A Balasubramanian of ABSL MF.

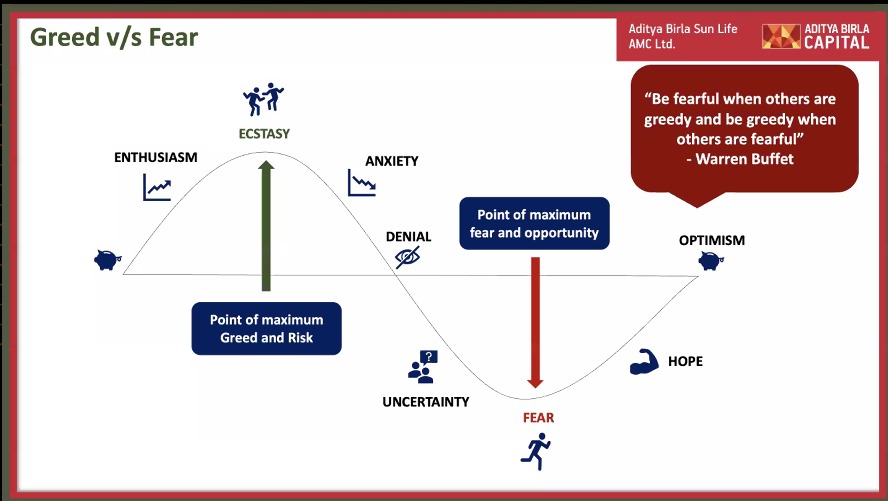

The Optimistic, entrepreneurial , new generation prefers to raise Equity capital over Debt unlike the previous generation. Markets Volatility causes ebb of Greed and Fear in Investors and it is necessary to work with a professional to avoid being subjected to it and exiting at the wrong time.

Why Equity?

-> Markets are Volatile By Nature. Stay Invested through the cycles.

-> Equity Outperforms All Asset classes.

-> Have Optimism, Stay Invested by taking guidance from professional

Secret 9- Super Power of Wealth: Youngistaan

This Secret of Wealth Creation was ably presented by new mother and Edelweiss CEO Ms.Radhika Gupta.

From the hapless and hopeless Generation Y (1960 -1980) the Optimistic Millenials (1981- 1996) and the Exuberant Gen Z have come a long way in their outlook.

50% of India is young i.e 550 mn people who spend over $500 Bn . They are also 55% of New investors and have contributed to over 1.5 Cr in SIP in the last 5 years. Over 80 % of them prefer to invest in Equity.

Start an SIP Piggy Bank when they are young. Talk to them about it and encourage them to save and allow them to spend their saving once goal is reached.

Wealth and Youth: Points to remember

-> Shape habits Early and give them a head start

-> Pass on Values by sharing your money stories. Else they will learn from Social Media

-> Be honest about money with your children

-> Take the right risks at right time

-> Pass on Legacy in a liquid portfolio and not illiquid portfolio like land, buildings

Secret 8 – Simplifier of Wealth : Be Disciplined with SIP’s

This secret of Wealth Creation was presented by Mr. G. Pradeep Kumar, CEO, Union Mutual Fund.

SIP has become more popular than Mutual Funds. But due to our fascination to gamble, we have more investors in crypto than Folio’s in Mutual Funds. All of us are emotional about our investments and SIP is the best way to take the emotion out of our investing.

-> Best way to participate in India is through Equity -> Best Way to participate in Equity is through Mf’s -> Best way to Invest in MF’s is through SIP’s

-> Start Small Start Now

-> Increase SIP by 10 % every year as income goes up and reach your goals faster

-> Stay Invested and withdraw only for goals

-> Personal finance Professionals help you stick to the discipline

Secret 7 – Commander of Wealth: Mind Your Investment Behaviour

Swarup Mohanty, CEO, Mirae MF presented about the quirks of Investor behaviour that causes them to get lower returns from their investments and proves an obstacle in wealth creation.

Process of A Financial Plan:

Step 1: Meet your Advisor

Step 2: Discuss Your Goals

Step 3: Get your Risk profile Assessment done

Step 4: Make a Financial Plan

Step 5: Make appropriate Scheme Selection

Step 6: Do Periodic Review

Most people want to skip straight to Step 5.

The real star of a Financial Plan is the Goal. The Rockstar of the plan is the one who help you get there.

Mr. Swaroop Mohanty, CEO, Mirae

-> Right Investment is not about return generation, but risk mitigation. Are you staying closer to your risk profile ?

-> Best time to buy is when you have money

-> Make Volatility is your friend. It helps us to buy assets at good prices.

-> Beware of Behavior Bias – Loss Aversion, Herd Mentality, Market Bias, Asset class risk

Secret 6- All Rounder of Wealth : Strength of Asset Allocation

The strength of Asset Allocation through Multi allocation funds was presented by Mr.Kalpen Parekh, DSP MF.

-> There is no consistent winning asset class. Right combination can get better returns than any individual asset class with less volatility.

-> Multi – Asset/Hybrid gives ability to say ‘I don’t know and I don’t Care’ about all external noises and geo political changes

-> 11 Dhoni’s Vs 1 Dhoni + Good Bowlers + Good Batsmen – which makes a better team?

-> US and India pricing currently reflect the optimism. Will the future winners be from elsewhere?

Secret 5 – Defender of Wealth: Tax Efficient Investments

Tax is the biggest single item of expense for Most of us and the need for tax efficient instruments was discussed by DP Singh, SBI MF.

-> Need to consider tax laws to ensure tax efficiency of investments

-> Conservative Hybrid and Arbitrage Funds may be considered for Debt Allocation as per current tax laws

-> Use Systematic Transfer Plan as a way to protect wealth

-> All cars even a Ferrari with an experienced driver needs brakes.

Secret 4 – Goal Keeper of Wealth: Goal Based Investments

The need for Goals to drive Investment decisions was driven home by Mr. Vishal Kapoor, CEO, Bandhan MF.

-> KYG – Know your Goals

-> One may different risk profiles for different goals

-> Chase Goals not returns.

Investing without Goals is like wandering in a desert with no markers.

Vishal Kapoor , Bandhan MF

One should have a goal, direction and milestones to know if one is progressing in the right path or not.

Goal based investments enable Investors to be objective oriented and disciplined. It also prevents them from reactive actions such as chasing past performance, unnecessary churn and suboptimal returns.

Investing success is all about having a plan and sticking to it with discipline.

Secret 3- Protector of Wealth : Minimize Risk and Maximize Returns

Mr.Rajiv Shastri, CEO, NJ Mutual Fund spoke about Wealth Protection

-> Returns can be generated only through conviction –

> Develop conviction through Patience, Discipline, Longevity, Diversification, Asset allocation, Risk Management, Expectations Management

-> Volatality is the PRICE of admission for the PRIZE of Superior Returns

-> Equity Volataility is not the unknown but known. But in long term of 15 yrs have NO chance of losing money.

Secret 2 – Motivator of Wealth: Aim and Achieve Financial Freedom

The buzz word of the youth on Financial Freedom was covered by Ajit Menon, PGIM Fund backed by the exhaustive market research that PGIM had conducted in this regard.

-> Parents should not be your Emergency Fund and Children should not be your retirement Plan.

->Mongevity – Money + Longevity. Money must last through early retirement and lengthening lifespans

-> There is only one financial goal for which you receive no loan – Retirement

-> Convert your passion into an income. 36 % have and 39 % considering secondary income either through skills or investments

-> Renew , Recharge , Never Retire

Secret 1 – Well Wisher of Wealth: Work with a Professional

-> Total Investing Life could be over 70 + years with 10 – 12 market drops of 20 % and a few 40 % drops. Work with a professionals to tide through the hard times.

-> 3 Essential Professionals – A doctor to protect your Health, A Lawyer to protect your assets and A Personal Finance Professional to protect your Lifestyle.

-> Share proper data and information with the Finance Professional.

-> Take 50:50 responsibility initially when you start working with a professional.

-> Do regular reviews.

Secrets of Wealth Creation: Event Summary and Learnings

Simple And Effective Ways to build Generational Wealth Creation is to Work with a Qualified Professionals who will be your guide who enables you to achieve goals through right planning, risk management and implementation.