Nothing is certain in the world except Death and Taxes. But we are constantly trying to postpone/reduce both as much as possible. So as law abiding citizens of India, what are the options we have to save as much tax as is lawfully possible ? what is the right way to look at these tax saving investments that we usually scramble to do at end of the year?

<<This Post is written from the perspective of FY 2022 ending Mar 2022 and AY 2023 as per the old Tax System>>

Standard Deduction:

Income from Salary – An Employed Person or one deriving pension from his past employer can avail a standard deduction of Rs.50,000.

A family pension is considered as Income From other sources and is eligible for a standard deduction of 30% of 15,000 which ever is lower.

For Income from house property such as rent, a 30% standard deduction is available.

No proofs are required to avail these deductions.

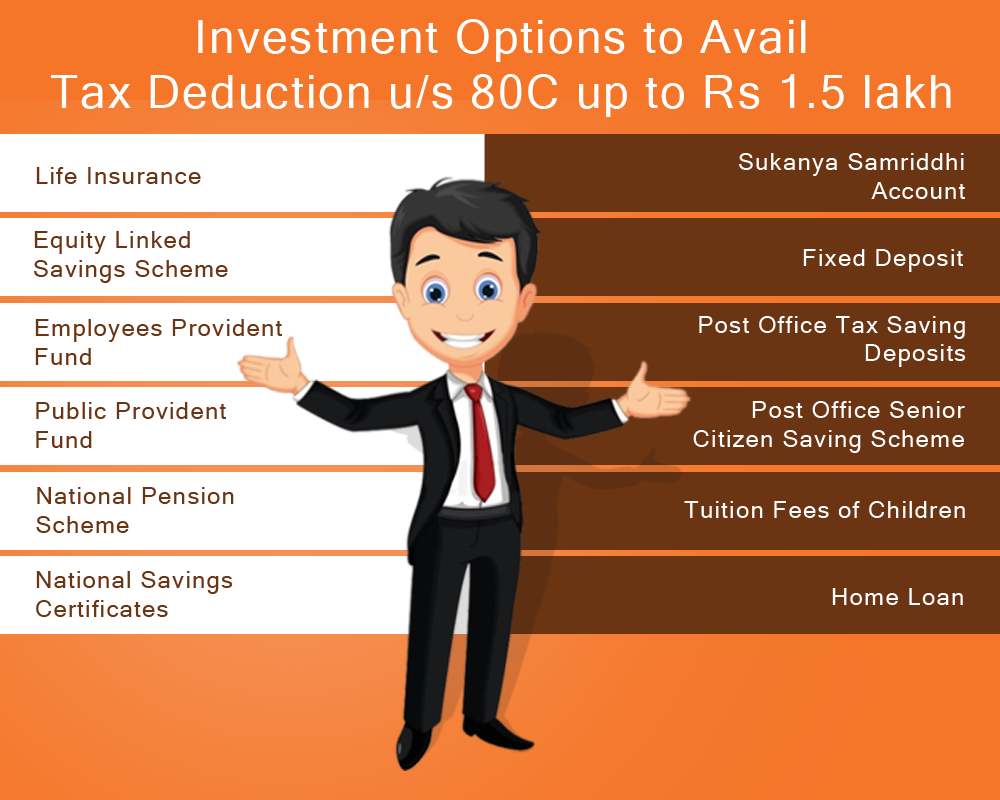

Sec 80 C : Limit of 150,000

This is is an extremely well known section which everyone uses to reduce their tax liability. Before evaluating the various options available to save tax under this section, one has to understand:

Cash Flow: Some people hate paying tax so much, that they are even willing to borrow money to invest and save tax. If you do not have the surplus to invest, you must reconsider your spending habits of course, but for now, it is better to pay tax and have the cash available for your needs.

Risk Appetite: 80 C has varied tax saving options from Insurances, FD’s, PPF which are all debt based save instruments to Equity Mutual Funds where the returns are market dependent.

Tenure of Investments: All 80 C investments come with a lock in period, but the lock in period differs from investment to investment. Exemption can be claimed only for the year on which investment is made and not for the entire lock in period.

Sec 80 CCD : NPS & APY

Contribution to ‘National Pension Scheme’ and ‘Atal Pension Yojana’ can give you an additional 50K exemption over and above 80 C exemption of 1.5 Lakhs. The contribution can be up to 10% of Basic + DA for employee and 20% of Gross Income for Self- employed.

If employer is directly contributing to NPS an additional deduction is available up to 14% for Central Government employees and 10% for everyone else.

Sec 80 D: Health Insurance and Health Checkups

For assesses under 60 years allowable claim is 25000 for self and 25,000 for parents under 60 years and 50,000 for parents above 60 years. What is an allowable expenditure in this limit

-> Health Insurance Premiums

-> Preventive Health Check ups

-> Critical Illness Rider premiums that are part of Term insurance also falls under Sec 80D

-> Medical Expenses of senior citizens not covered by Health Insurance

Who All may be covered in this : Self, Spouse, Dependent Children and Dependent Parents

Health Insurance companies often provide a discount for paying multiple year premiums. In such a case a proportionate premium may be claimed in each of the years. i.e for Eg, If Ms. Divya pays 50,000 has Medical insurance for 2 years for a family floater , she can claim 25,000 in each of the two years. You can learn how to choose the right health insurance for you here.

If the assessee or dependents have disability or any other serious specified medical condition, additional tax exemption may be available under Sec 80 DDB or 80 U as applicable.

House Rent Allowance and Sec 80 GGA

HRA tax exemption is the last of the below calculation:

-> Actual Rent Paid

-> 40%/ 50% of Basic + DA for non-metro and metro respectively

-> Rent paid less 10% of Basic + DA

If you do not receive a HRA or if you are self-employed, you are eligible for exemption under Sec 80 GG under the following conditions:

-> You are salaried or Self – Employed

-> You live in a rented accommodation and you or your spouse or children do not own any house in the same city

-> You did not receive any HRA

How much exemption can you claim under Sec 80 GG? This section is less generous than the HRA exemption itself, It will be the least of the three:

-> 5,000 per month

-> 25% of the adjusted total income

-> Actual rent – 10% of adjusted total income

Sec 80 E : Interest on Education

Interest Paid on Education loan can be availed as a deduction for upto 8 years. The loan can be for Education of Self, Spouse or Kids. There is no Rupee limit laid out.

Sec 80 TTA and Sec 80 TTB: Interest Income

Interest from Savings Account is exempt upto Rs.10,000 under Sec 80 TTA. This is not available for interest from FD’s, Recurring Deposits, Bond Coupons etc.. This provision makes it more sensible to keep our liquid funds in high interest earning savings bank like IDFC, AU Small Finance etc

For senior citizens tax exemption on interest on deposits including savings, fixed deposit and post office deposits are available up to Rs.50,000 under Sec 80 TTB.

Section 80 EE: Interest on Home Loan

For First time Home owners an additional 50,000 tax deduction is given over and above 2,00,000 interest deduction applicable in sec 24. If you are buying a house, just to be able to save tax, you are doing a big mistake. Even in the current interest rate scenario, the poor rental yield in most urban areas does not make owning a house a great investment. If you would anyway buy the house irrespective of its investment value or have already bought one, please avail this to your advantage.

Old Tax Regime Vs New Tax Regime:

New Tax Regime is mostly about simplification. In most circumstances it disallows most deductions in both gross and net stage. I’ve hardly ever found it to be more beneficial than the old regime if your objective is to save tax. But if you have cash flow issues and you would rather not lock in your money into investments you may consider opting for the New regime. You can check out for your specific case in the calculator here: Old Tax Regime Vs New Tax Regime Calculator. Employed may be able to update Tax regime every year, but for self-employed it is a one way street and I see no incentive to switch over to the new regime yet.

Conclusion:

I’d like to leave you with my below thought on this topic:

->Plan early and phase out your investments during the entire tenure.

-> Do not over obsesses about saving Tax. Do what you can to save it.

-> Don’t harbor too much negative feeling about paying tax. Such a feeling/mindset may hamper your income growth implicitly. Consider it as charity, contribution to the nation development or inevitable expense, whatever gives you peace of mind.

-> Do not invest only to save tax and to maximize deductions. Your life goals are more important than just obtaining tax credit. Plan your investments to be in alignment with your life goals. A tax saving is just an additional feature of an investment like leather cushions on a car. You would not buy a car jus for the leather cushion right ??!!

-> File your returns on time and avoid any penalty.

For specific questions, please reach out to your Chartered Accountant.