Retirement of the Previous Generation

My Grand Father retired from a state govt job in 80’s. Life expectancy then was about 53 years. He enjoyed a decent pension during his life time and my grandmother who survived him by another 2 decades also got a government pension.

My Father retired from a bank’s job in the year 2010. The Life expectancy then was about 66 years. He enjoyed a good pension till his passing away in 2020. My mother gets a fraction of his pension has family pension. While it may not be as much as the full pension, it is a fair sum and significantly covers her simple life fairly well.

One thing that worked very well for the previous generation is the Indian Family System. Children were expected to and most often took care of parents in their old age. Government also passed laws stating it is the duty of the sons and daughters to take care of their aged parents. Senior Citizens home was a sad looking shared accommodation and was generally was looked down upon by the society.

Generation X retirement

In 2004, (precisely the year I joined work force), Government replace the old pension scheme with the new pension scheme for all government and semi- government employees other than Armed Forces. Everyone who joined after this time period will be contributing to their own retirement funds – whether they work for the government, banks or any private institutions.

Ofcourse, even before 2004 pension eligibility was limited to government servants and private workers got negligible to nil pension. Pension was infact the most attractive thing about a government job back then apart from many other perks. But since government jobs were far and few between, a sizable portion of the previous generation retired without pension. Based on salary and family circumstances, the retirement corpus varied. Even the private schools were reasonably priced and affordable. Wedding expenses including Gold ornaments was one chief drain of the resources.

Today retirement homes are private colonies with 24/7 medical care, recreation facilities like gym swimming pool, common kitchen and managed house keeping. It is a great boon and a preference for elderly couple who do not have children or have children living abroad and a growing community of those who prefer their privacy and want to enjoy their old age.

Retirement or Redundant

Retirement Age continues to be at 58/60 years today. But the new age jobs require constant updating of knowledge in their fields of expertise with ever increasing demands on specialized knowledges which are moving in a fast pace. People who will not be able to keep pace with these fast paced changes are getting redundant in their old jobs. It has become important to prepare for an early retirement even if one does not intend to retire early.

Retirement Conundrum

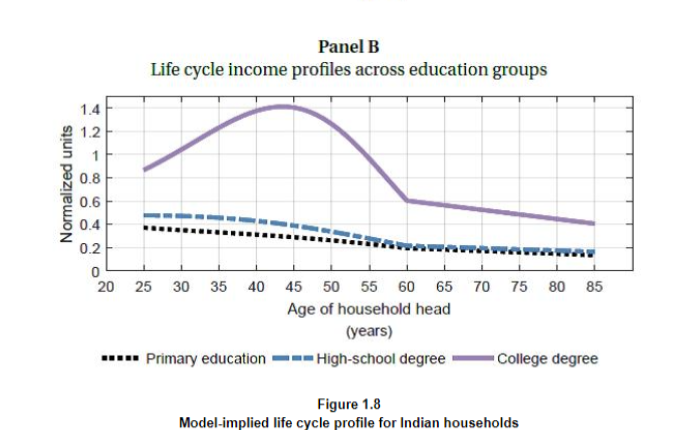

So how prepared are we to face this retirement conundrum? Longer life span, a more comfortable and expensive life, early retirement and nil to negligible pension benefits from employer.

The simple and only way to solve this issue to is to save aggressively from the start of our employment. This is of course obvious to all. So what are the guidelines that help you retire comfortably

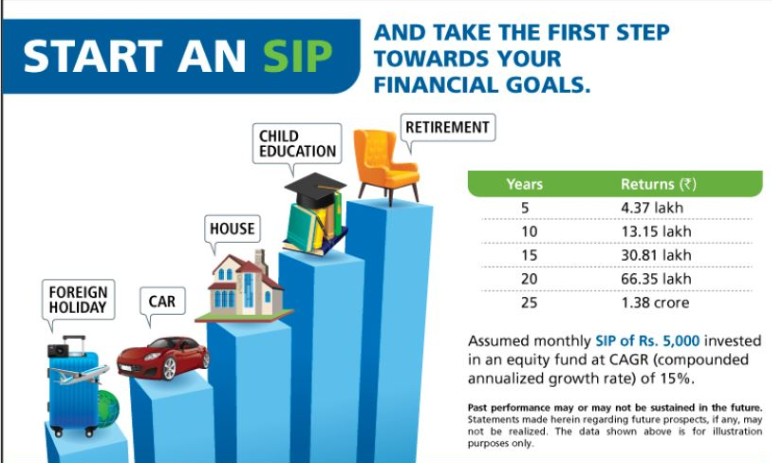

(1) Save 20% of your income towards retirement

During initial days of the career most people do not have any family commitments, during this time you can afford to save a much higher % of your income and afford to take higher risk with respect to exposure to Equity. Your first salary is a great time to start a dedicated SIP towards retirement.

If you find it hard to save when your salary is low, it is impossible to save as your income goes up. Life style inflation is real and it creeps in quickly.

(2) Goal Based Saving/Investing

It is understandably difficult for us to think about retirement early in your career, I’m so young, I want to buy a Car, home. go for vacation and lead a good life now. It is important indeed. However all short term and long term goals can be achieved by planning for it judiciously. Goal based savings can help one achieve their wants by systematic savings and increase the joy of through deferment rather than instant gratification.

The other side of this – ‘Say No to Loans’ esp consumer loans, personal loans and even vehicle loans. Unless the purchased item can directly improve your earning capacity, save for the goal equivalent to the EMI you would be paying otherwise to obtain the item.

(3) Do not dip into your retirement savings

Life will happen and bring you compelling circumstances from a medical emergency, a business opportunity from a friend, a car breakdown, an unbelievable sale of latest iphone and other such things. It is important to not dip into this money for any of these things. Ofcourse you would totally believe that this money will be doubled and returned in no time. But realistically it hardly happenns.

(4) Illiquid & EEE Investments

Increased exposure to equity is good. We have a long wat to go in that direction. But it is also important to recognize the importance of investing in fixed instruments that are in Exempt, Exempt, Exempt (EEE) category.

Why EEE ? As your income grows, protecting investment gains from taxation will be very important. we have several options in our country that provides fixed gains with nil to negligible risk. While this may not outpace inflation, the power of compounding and absence of volatility makes it an important part of retirement planning. Some of the instruments are : Employee Provident Fund, Public Provident Fund, National Saving Certificate(NSC) and also endowment and guaranteed savings plans of insurance companies.

The illiquidity of these instruments also discourage us from dipping into our savings for purposes other than retirement.

(5) Work with A Financial Planner

A good Financial Planner is a catalyst that keep people on the right track. Financial planning is indeed simple and basic just like keeping fit, eating right etc. There is often a gap between our intention and execution. And we have numerous questions with respect to the implementation. That’s when most realize it is not as simple as the influencer talked about it the viral video.

If you already have a good understanding of your self and the markets you can use the planner as a sounding board. If not you can use the planner as a guide/mentor. Hiring a planner sets out the intention in your mind, that it is important and you are willing to spend time and money in this. This simple activity can set you apart from most people.

(6) Take Adequate Health Insurance Early

Even when your employer has covered you and your family, it would be advisable to have a separate private health insurance that will continue to cover you during your retirement. Health expenses are the biggest concern during retirement and one unforeseen medical emergency can set you back by years and create a dent that cannot be filled.

Health insurance at a later age also come with a lot of undesirable factors such as loading, co pay etc which can be avoided when taken early. One may be denied a cover too. For better guidance on how to choose the right health insurance refer my previous post on ‘Everything you need to know about buying Health Insurance’

(7) Asset Allocation

It is tempting in a Bull Run to put all the money into the stock market and to pull out everything in bear run. We must always work with the assumption that we do not know what the future holds, and hence it is important to maintain a asset allocation. What would be a good asset allocation is a topic on its own. This is a place again a financial planner can help you choose an appropriate asset allocation for you.

Many retirements have been spoiled by over exposure to stocks that was hit badly during a bear market. So do not take this lightly. Infact asset allocation is the single most important factor that will determine your portfolio risk and return.

(8) Withdrawal Rate

Most people talk about building a corpus for retirement, but there is very little discussion on withdrawal.

Ideally a withdrawal lower than the growth of the corpus would ensure that the corpus outlasts you. However this depend on several factors outside our control like inflation, rate of return etc

So what can we do:

-> 30 – 50% – through a fixed guaranteed plan

-> 20 – 40% – through an annuity plan

-> 30 – 40% – through Systematic Withdrawals from a Mutual fund Corpus

During initial years the returns from guaranteed plan may be sufficient for your living. A deferred annuity may be bought during retirement that can add to the monthly income after a few years. SWP withdrawal may be started once both the income together falls short of the needs.

None of this planning accounts for the retirees wanting to fly abroad to visit their grand children or anything outside of standard living expenses. One needs to maintain a separate corpus to do those things.

(9) Gainful Employment and Passive Income:

The easiest way for one to maintain standard of living is through part time gainful employment. A few hours a week consulting or teaching is a great way to give your time and knowledge and keep one active. Passive income such as rent, dividends, interest, royalties provide great cushion and stability to ones income needs.

Conclusion

Unlike the previous generation, who felt a emotional set back on retirement, new Age Indians have embraced retirement as a period to look forward to spending more time with family, doing things they like. This can only be possible when the planning is started early and done systematically.